A New Kid on the Block?

Google saw one of the most incredible bumps in recent memory, screaming up 90 points in Friday's trading. For a while, I was troubled to see Google sell-off after sell off in this one-time bell-weather. Two points are clearly demonstrated in this jump. Wall Street is extremely hungry for a winner... Secondly and more importantly, technological innovation will continue to drive the market. My hope is that the rumored debut of a Google type auction house will be rolled out sooner than later, which should put a tremendous amount of pressure on Ebay. Ebay will be forced to create a more customer friendly business! Speaking of Google, a start-up named Cuill will be the most innovative search engine to hit cyberspace. The "New Kid on the Block" will utilize two former Google system designers to build a larger, and more effective system of searching the web. (1) This may be a IPO to watch for in the future. I would welcome additional information to be published about his future listing.

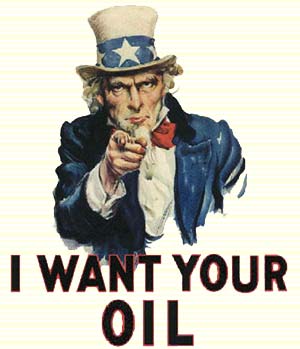

Oil Addicts...

I wondered if there would be more drug addicts in this country if 1. Drugs were cheaper. and 2. If drugs were regulated by the government. I would tend to doubt it... Drugs are simply appealing to certain types of people who either do them or don't. Oil is much the same way. I am not so sure that cheaper oil (While leaving more money in the consumer's pocket) will weaken our addiction. While filling up the other day, I asked a fellow customer if they ever thought they would be excited to get gasoline at $3.25 two years ago... The reply was...it sure as hell beats $3.50 or $4.00. We are addicted to our driving machines and will still buy this liquid gold until it truly hurts us. Presidential hopeful McCain speculated about a gas-tax holiday(a.k.a. government involvement). I guess this too would make consumers temporarily happy by depriving the nation of much needed tax long-term tax dollars, while giving consumers a temporary fix. The real problem is we have all become too accustomed to cheap gas. One play to consider in the UGA ETF (2)which rises of falls on the price of unleaded gasoline. My belief is that gas will hit an all-time high this summer, and back down during the elections so Presidential hopeful McCain can receive his coronation from the Big Oil companies that put Bush into office. No one will address the real problem with oil...the simple fact that our deflated dollar buys less oil!

The Body Electric

While Green Energies will be pushed by the Democratic hopefuls and their left-wing allies, there are simply too many of these companies. It reminds me of the .com bubble where ANY company that had a .com phrase in it became poised for high-oribit IPO's. There is no doubt that our leaders need to make some difficult energy policy decisions (sooner than later); there is no way that all of the new Green Energy start-ups can make it. The time for due diligence has arrived. The real question becomes...which of these companies will really make it. And of those...which will be able to market a credible product that actually makes the cost of electricity cheaper? Recycling hog dung does not count! (3) Regardless of any Green Energy, oil is here to stay. Just ask the Federal government if they have a vested interest in keeping the United States as oil addicts... I believe the figure is 18.4 cents per gallon. (4)

If You Can't Beat Em' Join Em'

Myself along with a number of fellow investors have made it a point to learn, study, and analyze financial market trends. And for the most part, it has been financially beneficial to do so. However, it is becoming somewhat apparent that the RICH and POWERFUL have an agenda that most middle class folks just can't quite figure out. What I would give to be a fly on the wall in a Fed meeting. It appears that Wall Street financials have a direct line of credit to the Fed. The Fed will pick and choose which of the investment banks receive welfare type loans (loans of last resort) and who will not. It is almost as if the Fed is able to play God. So maybe...just maybe...there are some financials that are worth looking at. However, I believe RKH (5)is still a long loser as well as RWR (6). I CAN'T WAIT TO HEAR NCC EARNINGS ON 4/21. Either a convincing case must be made to Wall Street or Good Night Irene!

Sources Cited:

1. http://seekingalpha.com/article/72518-under-the-radar-news-wednesday

2. http://moneycentral.msn.com/detail/stock_quote?Symbol=US%3aUGA

3. http://mark.asci.ncsu.edu/SwineReports/2002/koger.htm

4. http://www.gaspricewatch.com/usgastaxes.asp

5. http://moneycentral.msn.com/detail/stock_quote?Symbol=US%3aRKH

6. http://moneycentral.msn.com/detail/stock_quote?Symbol=US%3aRWR

Question of the Day?

Will C.C. Sabathia finish the season with an ERA under 5.0? (Over/Under)

6 comments:

Good question. I don't think so. Also, was nice to see Mr 4th Quarter Gilbert Arenas choke it up while Lebron continually beat double and triple teams to win that game all by himself. Big Z and West helped a little...

Tiger Coach,

CC will have an ERA below 5.00 at the end of the year. The question is will he be with the Indians or a different team. I still stand by my stance that the Indians should have traded CC and Hafner in the off season. They were at their highest value then.

Until we stop producing cars that run on gasoline, we will be oil addicts. My confusion comes because I don't know what the truth is. Is the world running out of oil? Does the US have enough oil to satisfy our demand for many years to come? I had a friend tell me that we don't pump our oil because when the rest of the world runs out we want to be holding all the cards. If that is true, at what point does the price of oil cripple our economy to the point where we have to pump it? My guess is $200 a barrel (maybe). And then, just because we pump it does that mean it will be cheaper? Shouldn't it be based on the cost plus a reasonable profit? Aha! There is the big black hole. Wouldn't oil still go through the markets and be sold at market prices not normal business transactions? Wouldn't someone want to make money on their investments (greed?)? Maybe the exchange rate impact would go away that is impacting the price of oil today, but there would still be speculation. And don't you think that as we start selling our oil to other countries, supply and demand (or the specter of these) will impact the price here? Again, this is all based on the assumption that the US is truly sitting on large reserves of oil. Who knows? We will not know the truth until the powers that be want us to know.

As I continue thinking, does anyone know how the oil system works? Does BP (or any other oil co.) pump any oil out of the ground anywhere in the world? If so, what does the price of oil in the world markets have to do with the gas price BP is selling at? I have to believe that it costs them less to pump and ship that oil than it would be to buy it on the open market. If not, why would they be in business? Or do they actually have to buy their oil on the open market? Or do they buy it from OPEC and other governments directly? I need to do some research here. My gut tells me that there is a lot of money being taken by different organizations and governments (taxes) along the way and ultimately paid for at the pump by the consumer. And to some extent by the individual gas station operator because they are dictated their cost and cannot shop around for the lowest cost gasoline. I will do some research and give an update. (My May project.) If anyone already knows about this or has anything to shed some light on it, please let me know.

B&D, these oil companies have "proven" reserves in projects around the world, they're not 3rd party participants in an oil exchange. Europeans are paying the equivalent of $5-$6 gallon for gas, our time is coming. We actually keep gas prices artificially low, as prices have not risen directly with oil. When that happens, the oil companies will make real money and be able to finance much more expensive projects under water, under salts, in shale, etc. Peak oil is coming....

Gentlemen,

My uncle who moved to Houston during the the first oil boom said that cheap foreign oil made U.S. oil unprofitable...This meant that margins were "not profitable" when oil was high back in the 80s. My guess is domestic drillers (such as PQ) will have a regular HAYDAY under the current circumstances. Domestic oil sold at peak prices. Big oil's argument is not that there is not enough crude...it is more along the lines of refining capacity. I maybe going long BP...a leap would run out to 2010... ALASKA...ALASKA...WE'RE WORKING WITH ALASKA..Was the SOHIO slogan of the 1970's. When BP bought them (another loss for Cleveland) they too bought the pipeline. From everything I have read, that pipeline was originally designed to reach N.Slope...supposedly the largest oil reserve in the world.

BD

http://www.alyeska-pipe.com/pipelinefacts/chronology.html

AX, I agree that our gasoline prices are kept artificially low. Right now I believe they are being kept low until after the election. The Republicans are trying to keep everything on an even keel as much as possible. Once the election is over I believe we will see gasoline begin its ascent to $5 per gallon. How long it will take I do not know. What will that do to the economy? The bottom line is that we have to get off of cars that run on gasoline. I know this is easier said than done, and I don't have the answer. Hopefully people a lot smarter than me can lead us in the right direction.

Tiger Coach, Who or what is PQ that you refer to in your comment?

Thank you for the response guys. I still plan on doing some more research into this.

B&D

Gentlemen,

The book The Fourth Turning (1)(a must read) called this current fuel crisis about 8 years ago. The book went on to suggest that people would move closer to work, work from home, and internet businesses would continue to be the wave of the future. Peak Oil can run a number of directions. This plays right into the analysis of AX who suggests that commercial retail shorts/puts are in...and would definitely be a way to play this market.

PQ stands for Petroquest. (2) It is a domestic oil driller...with great positioning. I will include that link as well.

Another golden opportunity squandered for the Tribe!

1. http://www.fourthturning.com/

2.http://seekingalpha.com/symbol/pq

Post a Comment