He's Back...First and foremost, I would like to apologize to my readers for not updating the site since May 22nd. As fate would have it, my computer came down with a case of the Swine Flu... While it was not fatal, the flue did cause a severe disruption in the ability to function properly. It is good to know people who are good at computer stuff. A special thanks to Yorg, who had the right perscription for the ailment...

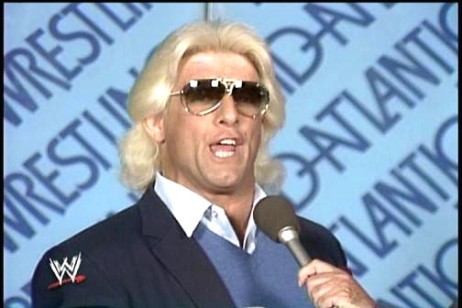

The Golden Boy...

I like Barack... and when I was in Washington last week, I could not help but think that this country will eventually recover. This is not to say that there are not more than a few bumps in the road ahead... (These are acknowledged by the President himself) But, Barack seems to have an uncanny aire about him that clearly separates him from many of his predecessors. Unlike W. Bush, Barack has a vision for the future and more importantly an aura of confidence that clearly suggests that better days are ahead. Time and time again it appears that our nation has been blessed by a sense of "right person" at the "right time". I do not buy into the fact that the media favors Obama. However, I believe that Obama has almost a sixth sense about him when dealing with the media. Matter of fact... like it or not... Obama is able to clearly articulate a future beyond the current crisis... I was able to see a more human side of the President as he and his daughters walked their dog at the White House. While many disagree with the way that the Administration has handled TARP, TALF, Chrysler, GM, and a plethera of visions for America's future, one thing is for certain, Obama has the political capital, and he is spending it wisely. I would like to remind readers that Bush was in a similar situation early in his administration, immediately after 911.

Conventional Wisdom...

Recently, Nouriel Roubini cited an article by Edward Harrison who gave cause for the recent market run-up. On almost a continual basis the market has escaped the jaws of death on almost a daily basis. Information that is bad is often times leaked early. Or better yet, there is other good news that trumps the bad. Even though the good news is based on a "not as bad as expected" scenario, one is only left to believe that a high degree of market manipulation is taking place. It is almost as if the PPT (Plunge Protection Team) is reading from a closely orchestrated script. I'll be curious if the market rallys on 9% employment...

Edwards cites a "Short-Covering Rally" as another potential explanation for the market. While many shorts have jumped from one week tot he next... and now one month to the next... the destruction of short positions are taking away the negative ebb of teh market tide, and more importantly adding momentum to the upside where there is little to no credence for an upside swing.

Last, Edwards made reference to a Paul Kudrosky interview which considered the current market rally as the new beginnings of a bull market. While the current rally is based on a late 2009/early 2010 recovery, even Kudrosky does not totaly buy in to it. Kudrosky acknowledges the bulls current hold on the market. However, he reasserts the systemic risk to the downside. "How much longer can central banks prop up the market?"

Market Watch

For me, I will have to pound my chest over the small victories I have gainned in the face of bull market onslaught. I have built a cash position, and licked a few wounds. In other cases, I have simply let some of my options roll...especially those with longer x dates. Trust me, I would much rather be betting on a Dow 20,000 scenario... I just don't buy it now... at least not yet...

SLV, D, and NEOP have been winners for me.

I will look to capilatize on a recent market run-up on those stocks which depend on consumer discretionary.

WSM, WYNN, GAP

2 comments:

Ahhh, the Golden Boy was the best. Recently seen getting his butt kicked by his son-in-law. We need this market to get the a-kicking it desereves but won't happen today as jobs numbers were mysteriously 200K less than ADP numbers even as unemployment climbed 1/2%.

Exactly… “How much longer can central banks prop up the market?” In effect, as long as TARP money and central banks remain involved, the economy is still on life support. Stable, perhaps, now but still on life support. Central bank involvement is not sustainable for the economy, especially with the very real specters of inflation and high unemployment hovering over it. Inflation hasn’t hit yet, but the longer bailout monies linger, the more likely and more severely it will hit. I think finally this week Bernanke mentioned the inflation problem. Peter Schiff has been talking about this issue for a while (See youtube).

Post a Comment